Are megafunds killing venture capital?

VC funds are getting bigger — and so too are the industry's mistakes

In the days of yore, $214m would have been a decent-sized venture capital fund.

US VC heavyweight Andreessen Horowitz’s first fund in 2009 was $300m, the first three Founders Fund vehicles by Peter Thiel oscillated between $200m and $250m, and even as recently as Q3 2022, the median US fund size was still barely $50m.

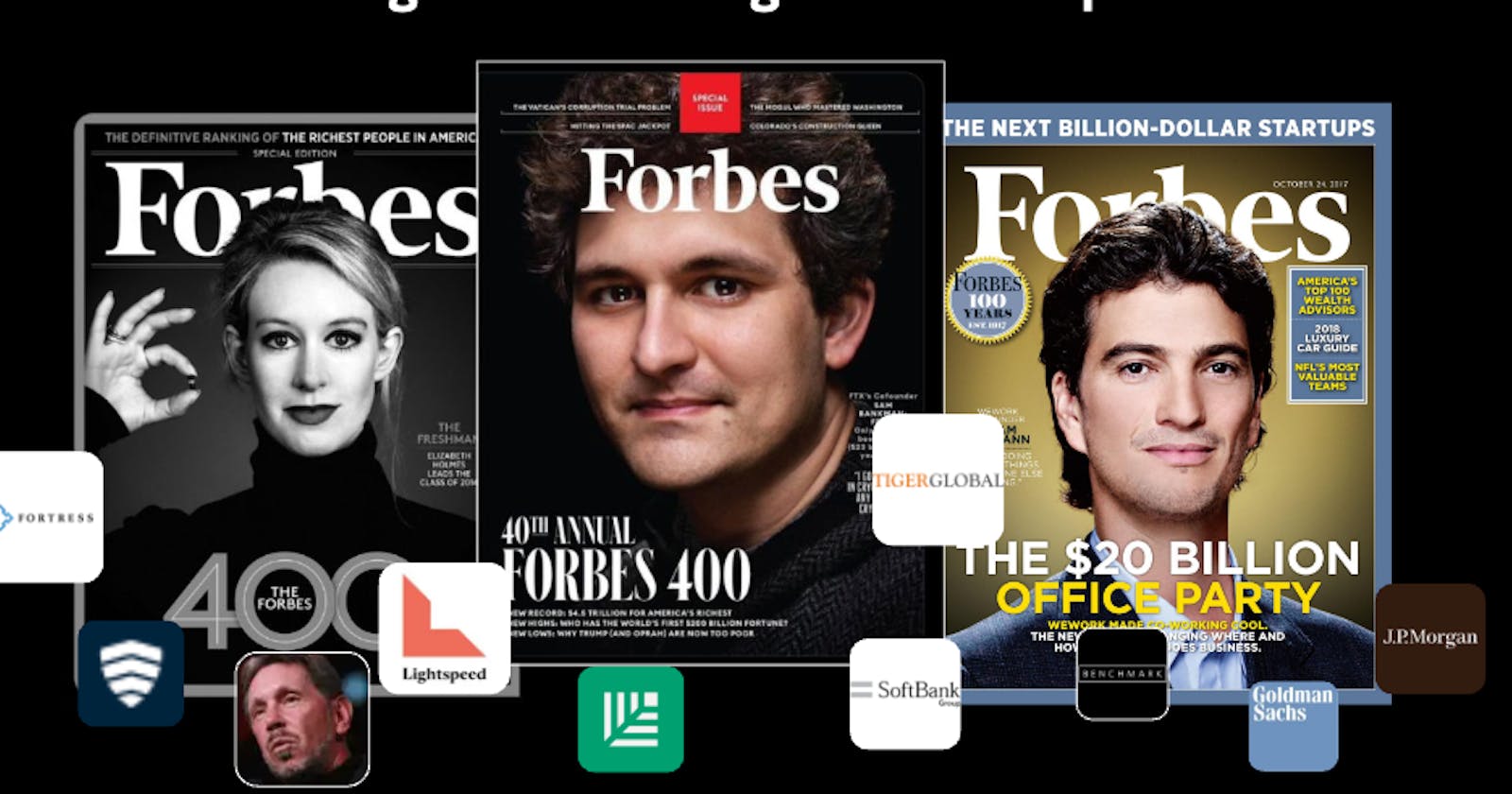

Yet $214m is how much Sequoia bet and lost in a single investment into the infamous crypto startup FTX. This single investment was as big as many of the earliest VC funds, and the Sequoia fund itself that backed FTX was over $8bn in size.

Sequoia described FTX (in a now-deleted article) as “a company that may very well end up creating the dominant all-in-one financial super-app of the future.” The gushing phrasing recalls what Softbank’s Masayoshi Son said about WeWork in 2017: “We are thrilled to support WeWork as they…unleash a new wave of productivity around the world.” Two years later, in 2019, the $100 Billion Vision Fund took a $4.6bn hit on that investment.

Is there some link between bigger funds — with more cash to splash — and these massive losses?

Capital concentrates into megafunds

It’s not just Sequoia and Softbank that have gone big. VCs of $1 billion or more have received 60% of the capital so far this year — compared to 34% in 2021. Newer, smaller funds, on the other hand, are being squeezed out, despite evidence they normally outperform.

Capital is becoming increasingly concentrated into a few hundred megafunds around the world, with the top 20 VC brands now managing over $200bn, which translates to 10% of total VC assets globally.

The ratio would likely be even more skewed if we counted the so-called “VC outsiders” — companies like Softbank, Tiger Global, Partner Fund Management, Toma Bravo and other private equity and hedge funds that have poured billions into the VC game recently.

And as megafunds grow fatter, they ultimately face the same challenge: how to spend that money and make a return. It’s time to do some maths…

Size matters

In VC size does matter because of (a) maths and (b) access.

Let’s first look at the maths. VC exits follow a power law distribution: 20% of a fund’s portfolio will normally account for over 90% of its returns. 25-50% will return nothing or close to that.

If you had a $100m fund and wanted to triple your money (a benchmark VCs usually aim for) each portfolio company would need to have a shot at returning the entire fund. For example, if you managed to defend a 10% stake in a $1bn exit, that company would net you $100m, which was your original fund. A $20bn outcome, like Figma, would get you $1bn even if your stake was only 5%.

And if you had an $8bn fund? In that case, a $1bn outcome only returns you 20% of your fund. And the $100m from a unicorn exit? A failure that does not even move the needle.

The second problem that comes with size is access.

Data from Dealroom.co suggests the most successful “unicorn hunters” — VCs backing billion-dollar startups — are the ones that first invest in these companies at the seed stage. But to access a seed round, or even a Series A, you need to be able to deploy capital in such stages and the size of the tickets you are writing must be meaningful to your fund.

Herein lies the access problem: seed rounds are usually only a few million dollars in size. The median Series A is about $10m in the US and even less in Europe. If your fund is $50m or even $100m, seed cheques are still meaningful. But if your fund is a billion-dollar megafund, those tickets are not worth your time.

Are megafunds killing VC?

All of this means that we are now in a time when, for large VC funds, a startup achieving a billion-dollar outcome is meaningless. To hit a 3-5x return, megafunds need startups that can:

take on hundreds of millions or even billions in investment, and

exit at north of $50bn dollars.

If you look at all public tech companies today, less than 50 have achieved that valuation.

So when you meet a founder that’s attracting global PR, is prepared to raise huge piles of cash, and to quote Sequoia’s deleted article again, is pitching you a “vision about the future of money itself—with a total addressable market of every person on the entire planet,” large investors are tempted. They are tempted to jump on the hype bandwagon and “make a Uber” out of it. (Uber’s market capitalisation, by the way, is just over $50bn.)

Masayoshi Son allegedly jumped on the wagon after only 28 minutes of meeting WeWork’s Adam Neumann.

Sequoia did with Sam Bankman-Fried despite the fact that the “fucker was playing League of Legends through the entire meeting”. The observation was an ironic foreshadowing of his disastrous, rules-don’t-apply attitude which led to the company’s collapse.

This mentality and the concentration of capital into only a handful of funds is creating an ever-growing funding gap between the founders whom these funds back and everyone else. What’s more, larger funds are creating a close network of hype in their quest to engineer the next $50bn+ Uber, which means they naturally end up investing in a lot of the same companies.

The slowdown in the tech market will only accelerate these forces.

This article was first published on Sifted.eu on Dec 16th 2022