The Deck That Got Me To First Closing Reviewed Live By An LP

The VC Fund Pitch Deck That Got Me To The First Closing Of My First Solo GP Fund

Table of contents

- Shining a light on an opaque industry

- TLDR Summary of Key Lessons

- Do we really need more VCs to “emerge”?

- Slide-by-Slide Analysis

- Slide 1: Title and Contacts Slide

- Slide 2: Investment Thesis

- Slide 3: Team

- Slide 4: Team

- Slide 5: The Opportunity

- Slide 6: The Opportunity

- Slide 7: Community Track Record

- Slide 8: Key Advantages

- Slide 9: Ecosystem Value Add

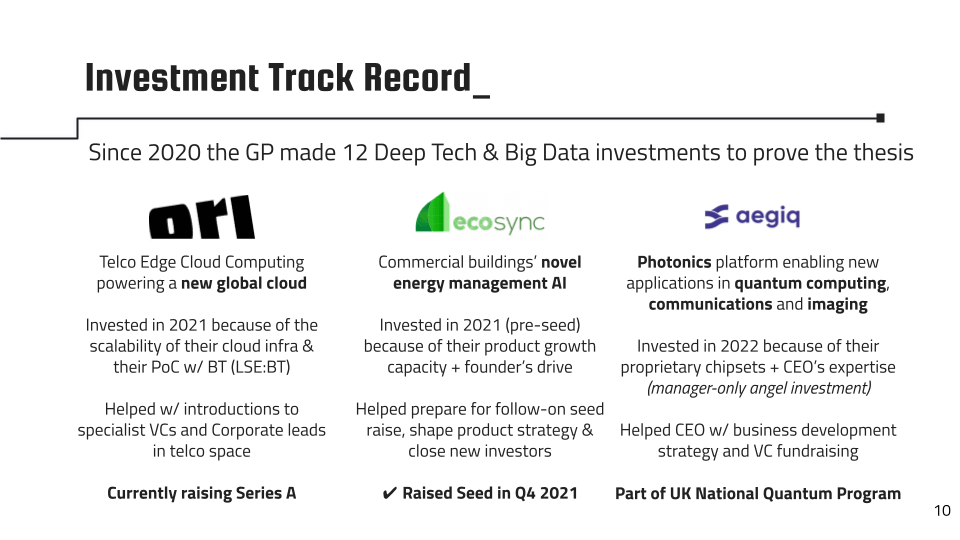

- Slide 10: Investment Track Record

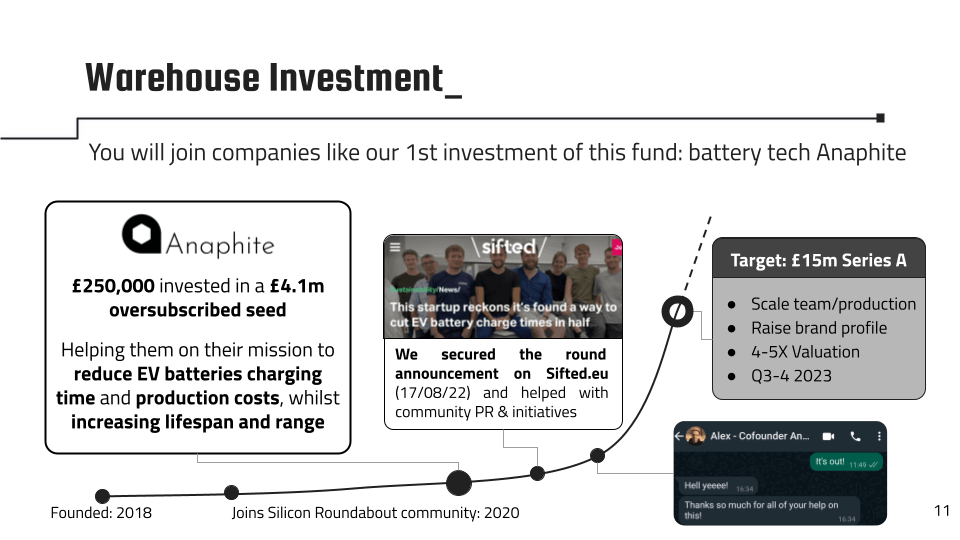

- Slide 11: Warehouse Investment

- Slide 12: Funding Partners

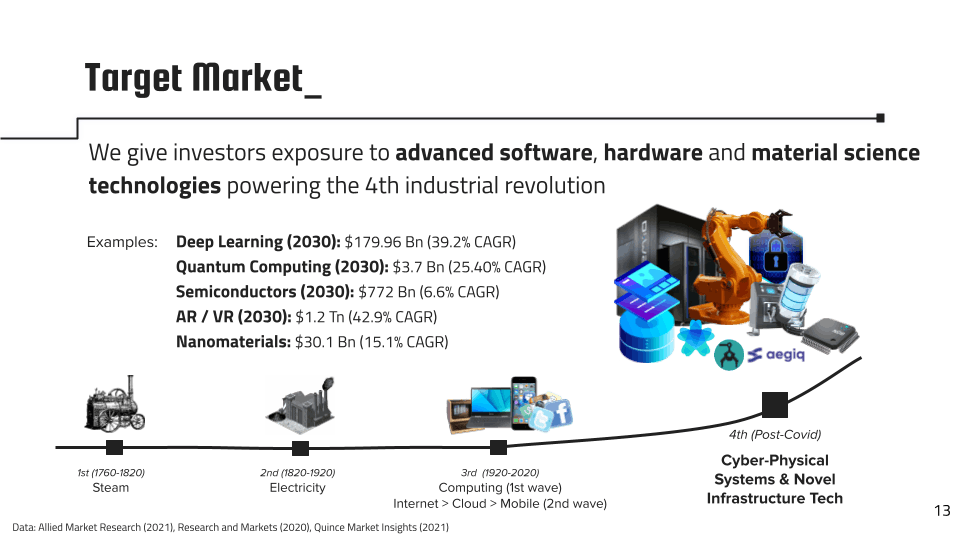

- Slide 13: Target Market

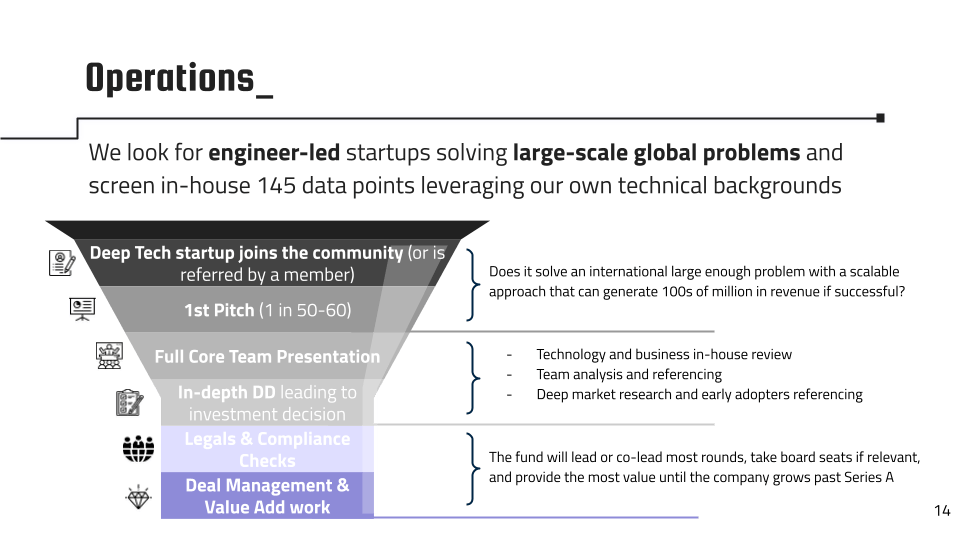

- Slide 14: Operations

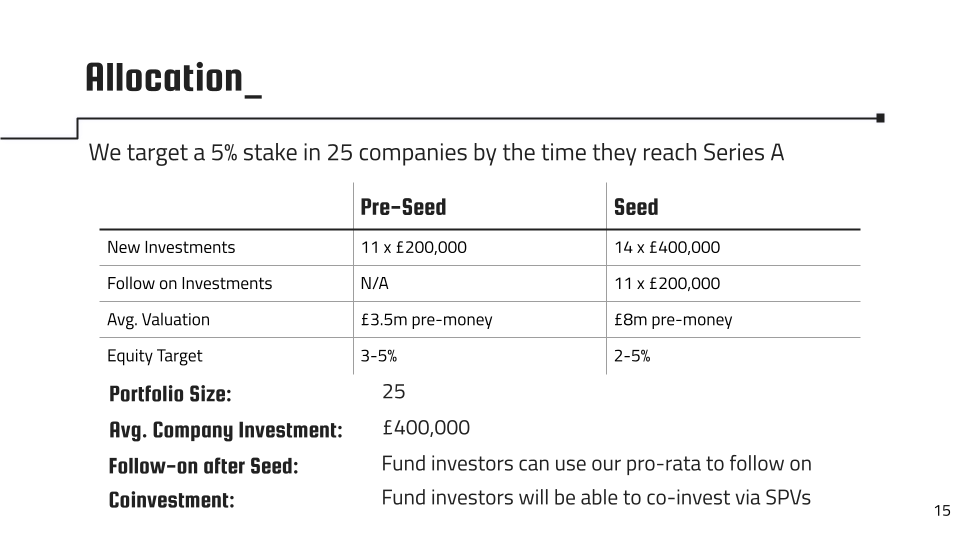

- Slide 15: Allocation

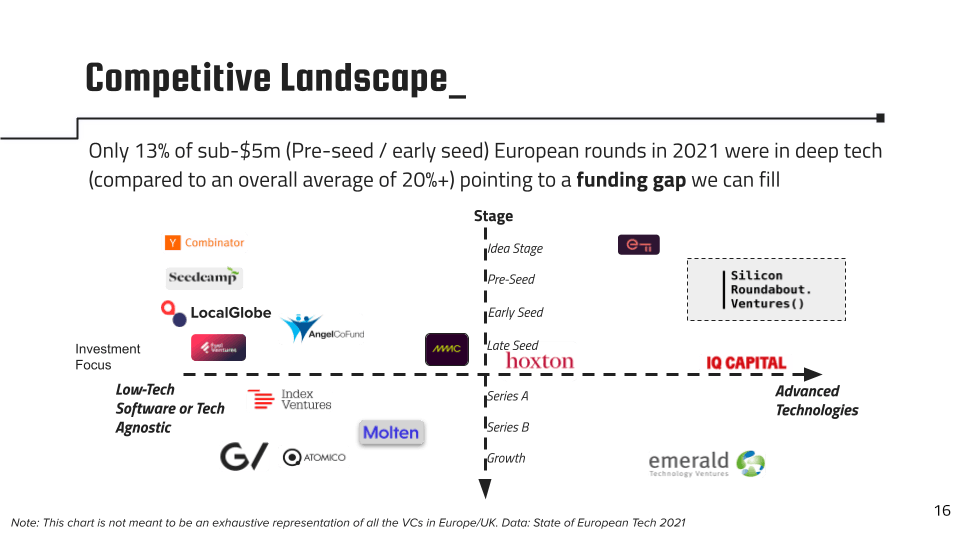

- Slide 16: Competitive Landscape

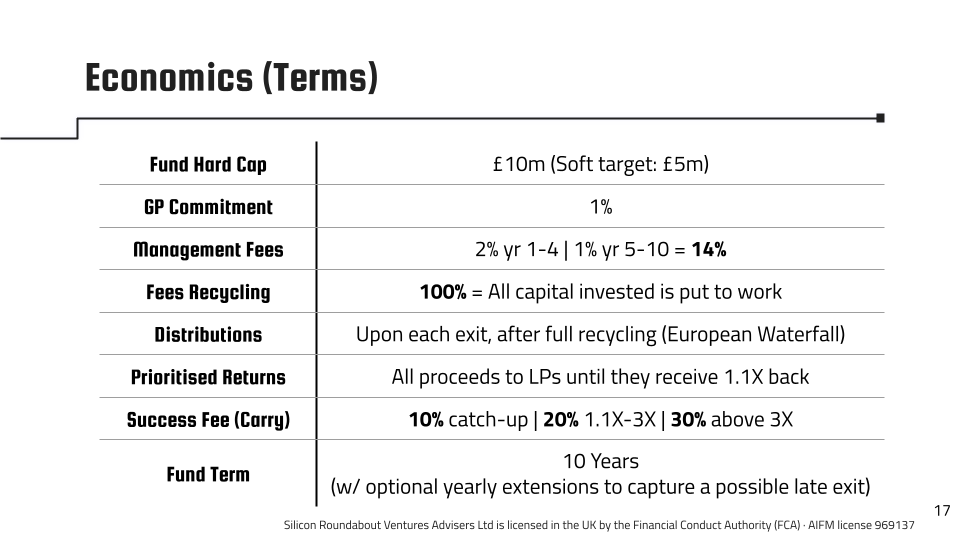

- Slide 17: Economics (Terms)

- Slide 18 & 19: Thank You! + Disclaimer

- Slide 20: Appendix

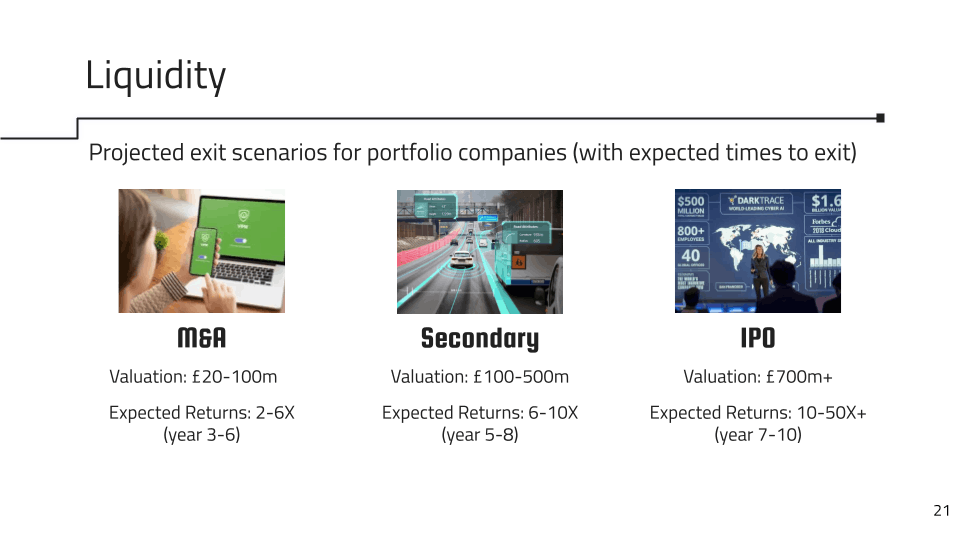

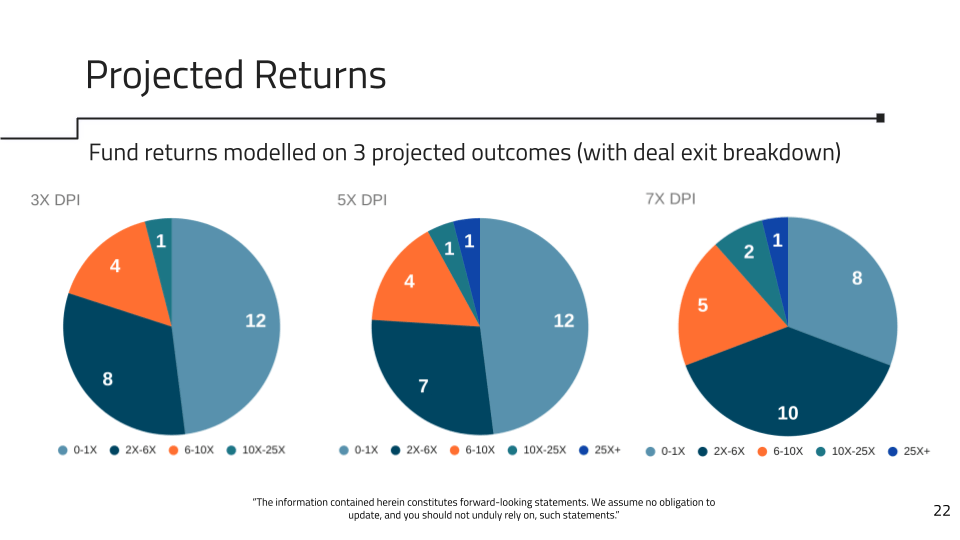

- Slides 21 & 22: Liquidity + Projected Returns

- Slides 23, 24 & 25: Case Study

- Slide 26: Why Nots

- Slide 27, 28 & 29: Fund Structure + Our Values and Principles + LP Investor Onboarding

- Deck Review Wrap up

- Conclusion

As an emerging venture capital (VC) fund manager, creating a pitch deck that stands out and effectively communicates your fund's strategy is crucial to attracting limited partners (LPs). In this article, we will share actionable insights on how to build one by going through the one that got me to my very first closing and have it grilled live by an LP investor specialising in emerging managers.

Shining a light on an opaque industry

Why bother? Because the VC industry is incredibly opaque and I really struggled to build mine!

Very few venture capital fund decks are out on the open web. And probably none from emerging managers that are complete outsiders to VC and raising their first nano fund. I’m here to challenge that by sharing the very deck that I used for my first closing a few months ago. Just as it was. Before I could start adding details on companies in the portfolio (like my current version has) or build a track record from previous funds (like most examples online).

And I will do it by pitching it to Maria Marques Nunes from Aldea Ventures: a fund splitting their investments 50% directly into companies and 50% into emerging fund managers.

The goal is to pay it forward to fellow emerging VC managers by sharing actionable insights that can hopefully help them improve their pitch decks faster than I did and increase their chances of securing investments from LPs.

TLDR Summary of Key Lessons

Showcase your team background and track record

Have a clear and concise investment thesis

Include your target fund size and allocation strategy

Showcase your connections in the VC ecosystem

Don't be afraid to include numbers

Consider mentioning the fundraising timeline and definitely include the key economic terms

Do we really need more VCs to “emerge”?

In these challenging times, we face global crises, from financial uncertainty and the threat of hi-tech warfare in a de-globalising world to the devastating impacts of climate change. The world urgently needs innovative founders to develop and commercialise new technologies to address these and other issues.

Likewise, it needs bold investors who are willing to support these founders, even if they don't fit the traditional VC-backed startup mould. The tech and venture capital sectors also need to become more diverse.

That’s why I believe we must encourage new fund managers, preferably from non-traditional backgrounds, to establish VC firms and challenge the status quo. In Europe in particular, VC is still far from a zero-sum game, and we should support one another in growing the industry. I, for once, eagerly await the day when I can regularly invest as an LP alongside my VC career ─so far I have joined one LP syndicate. Since backing emerging funds can be as enjoyable and just as financially rewarding as angel investing in startups. But that's another story...

Now, let's dive into the live pitch:

Slide-by-Slide Analysis

This section, the core part, presents a slide-by-slide analysis of our pitch deck “first closing edition”, as I presented it to Maria. The conversation focused on the main presentation and relevant appendix slides, capturing key commentary and insights from both parties.

The transcript was edited to keep only the relevant comments and make it more easily readable:

Slide 1: Title and Contacts Slide

No comment ─it’s just an introduction slide. I chose to have a one-line statement and contacts here. The tip came from the pitch guidance from VCLab, which by the way is an awesome online programme for emerging managers we went through with Silicon Roundabout Ventures and that proved very useful to launch our fund. Their frameworks and peer review groups helped a lot in finessing both our thesis and initial deck.

Readability note: if you see the images with a dark background in dark mode, switch over to light mode (the sun/moon icon in the top right corner)

Slide 2: Investment Thesis

Maria Marques Nunes: "The investment thesis is important information for us. I like that you have the main information in the first slide, like the target size and the focus on deep tech. Institutional investors can often only invest in certain jurisdictions. On the first page, I would look at the target size, where it is based, and in which industries you are looking to invest."

Francesco Perticarari: “Okay, so I didn't do as bad as I thought the first one”

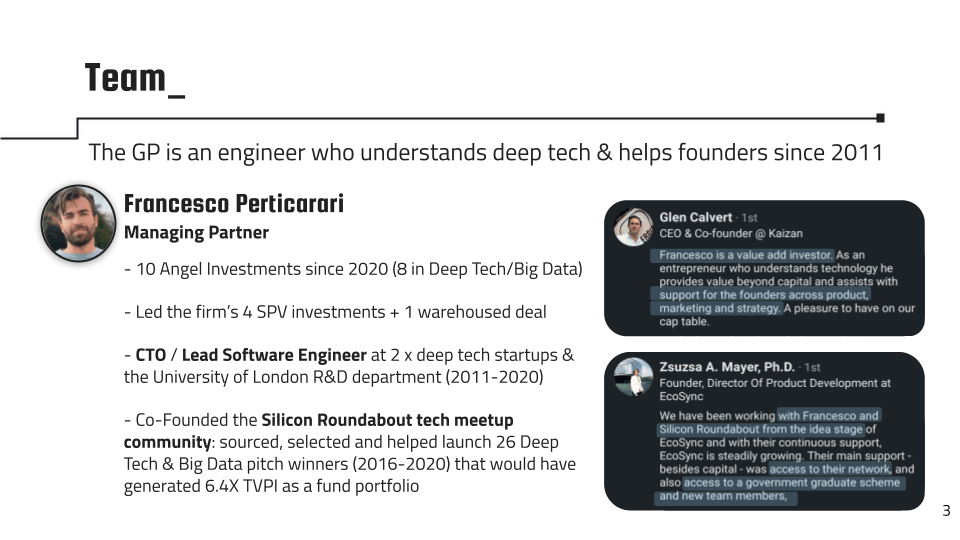

Slide 3: Team

Maria Marques Nunes: "Here understanding relevant background experience and track record is key. On the track record part, you have ‘10 angel investments’. I don't know if you have more information afterwards, but it can be quite useful if we see some numbers, as in what was your returns, or logos, if it's investments in known companies”

Francesco Perticarari: “Okay, and you normally see the team slides coming early in the deck, later in the deck, or you don't care?”

Maria Marques Nunes: “It depends on the funds. If it's fund one, it usually comes at the beginning because there's no portfolio yet. For us, in a fund one, the most important thing is the team. Alongside understanding the track records.

Slide 4: Team

Maria Marques Nunes: "Having a good support team, even if they are not as involved, like the venture partners here, can be important. Its importance ultimately depends on the context and relevance. If they have experience in a specific technology, like here you have in physics and computer science, LPs can understand that you can ask them for advice. Likewise, if they have experience in VC. For a fund one, it can be good to have people that can guide them in their chosen VC ecosystem. So these two ones you have here are important."

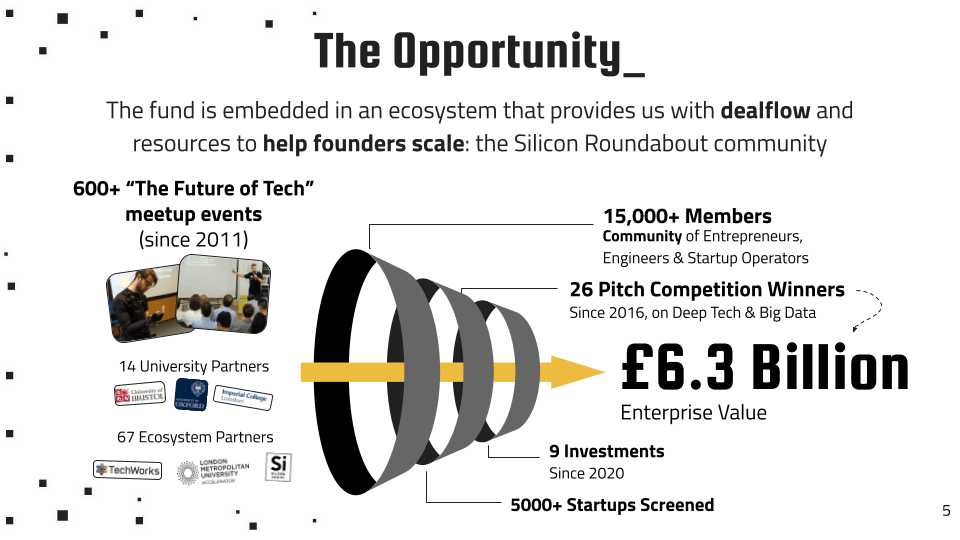

Slide 5: The Opportunity

Maria Marques Nunes: "The community aspect is interesting, but again if you have any numbers to validate specific investments, that can help. For the non-investment companies or the broader context, this can be ok as a slide because ultimately we would then expect the GP to explain these sorts of details to us if we progressed further."

Slide 6: The Opportunity

Maria Marques Nunes: "What we usually look for in these sort of ‘context’ slides is the rationale behind the fund thesis, where and at which stage the fund will invest, and if they have the actual knowledge to execute. Was the background operational, VC, entrepreneurial, or scientific?

We must understand the fund strategy and then the opportunity around this. What are the specific characteristics of the fund and is the team able to execute? Mostly we want to see what they've built before. As long as we see “something” interesting we can then ask about the details in the first call to understand better."

Francesco Perticarari: “Okay, so in general for emerging managers who have a hybrid record like mine, where it's not all about investments but also operational, are there any other indicators that you would value as a way to showcase past achievements? I mean, other than investment track record numbers?”

Maria Marques Nunes: “It depends, for example, if you have studies like a PhD or have worked with universities or corporates, or you helped build companies, or you were the first employee of some startups, or you founded one. It all counts if it supports your thesis and strategy. When we are looking for emerging managers, we always ask ourselves: ‘What is their past experience? Worked in a VC and is familiar with the ecosystem, has a scientific and technical background, was a serial entrepreneur or a mix?’”

Francesco Perticarari: “Makes sense. In my case specifically, I used the growth in company value from pitch winners from the community to showcase the value of the community from before I started investing.”

Maria Marques Nunes: “I see. I think it’s okay but you could probably make it easier to understand and differentiate between investments and non-investments.”

Slide 7: Community Track Record

Maria Marques Nunes: "Here I see more of the same, as in not investments done but investments you could have done if the community had had a fund, correct?”

Francesco Perticarari: “Yes, correct”

Maria Marques Nunes: "I think I'd consider bringing the investments forward. Because when you are sending the deck to pitch to investors, the first slides are the ones that they look at the most and not the last ones. So I would make sure those slides come a bit earlier in the deck”

Slide 8: Key Advantages

Maria Marques Nunes: "Here you are saying that through the community you have built you get your unique dealflow. I would be more specific on this either specifying the value it would have brought to the fund or they ways you source deals in detail"

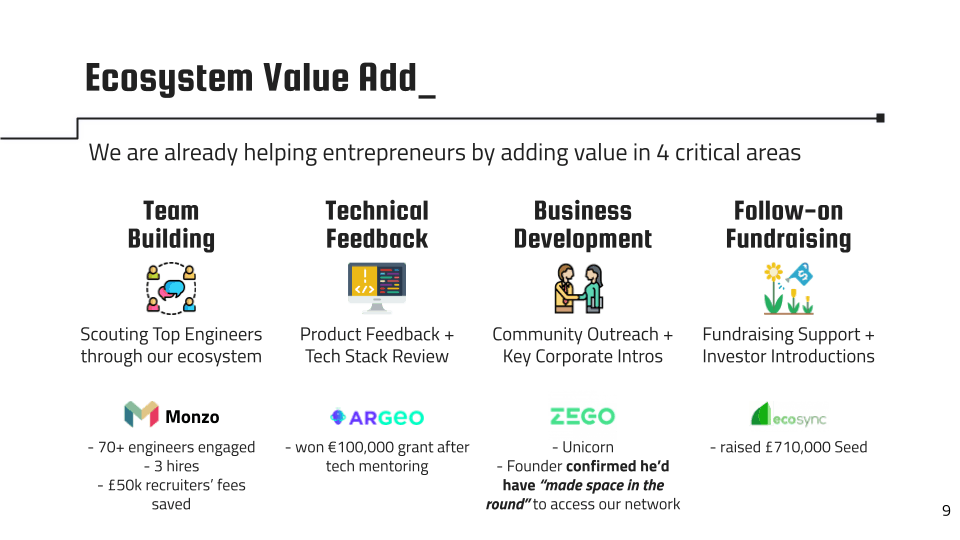

Slide 9: Ecosystem Value Add

Maria Marques Nunes: I would potentially consider merging some of these slides and reducing the information"

Slide 10: Investment Track Record

Maria Marques Nunes: "Finally we get some investment numbers! Here I would put the return on these"

Francesco Perticarari: “On this one, we actually had the returns in a previous version, but because one of the three raised the follow-on round with convertibles and one was a small pre-seed to seed increase, we were suggested to focus on other metrics, like the ones you see here.“

Maria Marques Nunes: "In that case, you could add well-known co-investors that participated in the rounds. In the VC world having a good network is important. And seeing that you can have relevant co-investors and follow-on investors can be a useful alternative indication you can use to showcase your investments”.

Slide 11: Warehouse Investment

Maria Marques Nunes: "This is a good one. Since it’s showing a company in the actual portfolio but I would also add the co-investors. If one of our portfolio funds is invested, it would be a way for us to validate that you invested in good companies. Or if you add as a co-investor someone we know and trust, it's a way to understand that you're picking a good company."

Slide 12: Funding Partners

Maria Marques Nunes: "I’m assuming this is a potential LP you showcase here. We usually do not see this in decks, and it may be a problem if they then don’t follow up into the first closing, but it's something that we ask for anyway afterwards. If you felt it was helpful when you did your first closing, I can see it as a positive”

Francesco Perticarari: “Yeah, we added this slide after Molten Ventures crystallised their commitment. Also to showcase who could be like a potential follow on investor for our deals”

Slide 13: Target Market

Maria Marques Nunes: "The market slide. You dive deeper into what you invest in and why. Here I would be curious about the knowledge needed to invest in this type of markets and industries. Because here you give some examples of industries you will target. In a way, I can see that your background and the venture partners experience can contribute to required knowledge to invest in these industries. However, I would then ask in a first call: ‘how do you have the right knowledge to pick companies in each vertical’."

Slide 14: Operations

Maria Marques Nunes: "In its current form I don't think this slide is necessary in the main deck. Maybe more for the appendix. You are showing your investment process… But I would be more curious about how you get deal flow, and where you look when it comes to sourcing companies. Is it just from your community, from universities, or from other VCs? Also, how do you then think about shaping the investment round? Do you help bring co-investors in? I think these are more important aspects than your back-office processes."

Slide 15: Allocation

Maria Marques Nunes: "It’s a good slide. I may just put the target size of the fund once again. LPs can do the maths of course, but it could help if you are glancing through to see if all adds up.”

Francesco Perticarari: “In reality, this slide can change a bit depending on the market response and how much money the fund ends closing in total, but we wanted to indicate the size and number of cheques we will be writing”

Maria Marques Nunes: “Sure. I agree. I would also put these numbers in.”

Slide 16: Competitive Landscape

Maria Marques Nunes: "Your positioning within the ecosystem. It’s interesting but I think this could also be potentially appendix material. It may be more relevant if you can also show some examples of connections, such as deals introduced to you or that you introduced to others and got done. So that we can see some glimpses of how you are connected within the ecosystem. I get that for what I see here you try to differentiate yourself from the generalist investors and funds investing at different stages."

Francesco Perticarari: “I wish I had done this call back before! Even if the deck changed a bit from this version since we’ve done the first closing, I can still see there are ways to improve it by seeing it more from an LP perspective”

Slide 17: Economics (Terms)

Maria Marques Nunes: "Yeah, that's this! This is super important, especially if it passes the first review. If the investment thesis is aligned with what the LPs are looking for, then this information is something we will look at. Some funds do not have this slide and I don't understand why. We want to understand management fees, the total target, the investment period, if there is a catch-up or a hurdle rate, and the carry structure. It’s fundamental to have this slide. Good job."

Slide 18 & 19: Thank You! + Disclaimer

No comment. We have contacts again and a Calendly link to book a call, should the LP want to use that.

The disclaimer is a legal requirement. We drafted it ourselves based on templates we found online, then we adjusted it during the process of becoming regulated as a small alternative fund manager in the UK.

Slide 20: Appendix

Francesco Perticarari: “That was the main deck. Afterwards, there are a few appendix slides. We added some to showcase more details on a case study deal and others to explain the fund workings, especially to less sophisticated LPs like angel investors that don’t regularly invest in funds. Since they are a major part of our fund 1 LP base.”

Maria Marques Nunes: “Yeah, okay”.

Slides 21 & 22: Liquidity + Projected Returns

Maria Marques Nunes: “The ‘Projected Returns’ one is interesting. Almost none of the decks I’ve seen have this.”

Francesco Perticarari: “ Do you think it could be useful?”

Maria Marques Nunes: “Yes, it's useful. Because it shows that you have a structure in your head and it summarises the fund model. It's good that you have these 3 scenarios computed here. It's not really necessary for a pitch deck as we would want to dig deeper into the fund model as an institutional LP but it’s useful information if you want to add a high-level summary this way”

Slides 23, 24 & 25: Case Study

We picked our pre-fund SPV Ori as a case study company to showcase what the deal was, why we invested, and how we helped the company with intros to relevant third parties in our network

Maria Marques Nunes: “It’s okay as appendix material. As a manager, you can put how and why you chose a company or what was the diligence process. It can be good info to give a general idea. When it comes to institutional ones like us, we would at some point want to see some examples of investment memos, check some references and talk to you to understand the reasoning behind actual investments. So be also prepared for that kind of material in a data room, if you pitch institutional LPs. But of course that comes potentially after the deck and the initial calls.”

Slide 26: Why Nots

Maria Marques Nunes: "These are companies you turned down, along with the reasoning behind the decision. Again I think it’s positive but definitely appendix material if you feel like adding it."

Slide 27, 28 & 29: Fund Structure + Our Values and Principles + LP Investor Onboarding

Maria Marques Nunes: "I see you have here the fund structure, some kind of personal value statement and a process for LP onboarding. It's not fundamental to have this information. Ultimately when we look into a deck, the first thing is just to see if it fits with our thesis. Like if it's a fund that can align with us and with our portfolio strategy. And then if the team has some evidence of a track record and demonstrated capacity to deliver on their thesis. After that, we like to dig deeper in our analysis with the managers, if we feel there is a fit. You can have extra bits of information like these slides in the appendix."

Deck Review Wrap up

Francesco Perticarari: "I guess we went through the whole thing. Any comments on how it's structured or on how it ranks compared to other decks you’ve seen?”

Maria Marques Nunes: “I think it's a good deck. Maybe you could leverage your experience more. Since you have a scientific background, it could better show how that relates to choosing the best-performing companies and how you then source any missing bits of knowledge to get conviction in your chosen verticals. Also, I would showcase better the VC ecosystem and network that you've built so far. But besides that, I think it's a good deck and it has the main information presented in a clear, simple format with neutral, easy-to-read fonts and colours, which sometimes is what many decks lack. Some don’t even have the target size.”

Francesco Perticarari: “Okay. And since we will open this up for other emerging managers to see, what are the top bits of information that LPs like you want to see in a fund 1 deck?”

Maria Marques Nunes: “Having the main information in the first slides and then at the end the terms is important. In terms of the top priorities for us, it’s critical to understand: 1) who is the team and their experience and track records; 2) the thesis, where and why the fund will invest; and then 3) the strategy of the fund and what are the unique features that set them apart from other funds.

Also: don't be afraid to put the numbers in. Because then when we speak to the GP we already know some examples of successful track record investments or other achievements, and we know roughly what the fund target size is and what is their thinking around allocation, follow on if any, and portfolio construction. Of course, we know that the market changes but it’s important to understand what kind of fund people are building. Some indication of timing can be useful too, such as the target for the next closing, although you could add that in the email accompanying the deck.”

Francesco Perticarari: “Great, thank you so much, Maria!”

Conclusion

Ultimately, a deck is just like a CV. It should be in constant evolution and its real goal is just to get you that interview. After that, if you get to make a good impression, it helps the decision-makers carry on with relationship-building meetings and perhaps get to an investment decision.

An effective pitch deck is all about showcasing your team's background and investment thesis and providing the core details on how the fund will operate.

Other key elements LPs will be attracted to are any evidence of your connections in the VC ecosystem and clear numbers and timelines that will make the pitch deck stand out and resonate with potential investors.

It’s also a filter for those who don’t see eye to eye with you. And a great way to get feedback too!

Sometimes helping you get a fast “no” is just as important to help you focus on those LPs that are truly aligned with your investment vision.

For us to get interest for our first closing it was important to focus on telling our story, align it with the brand and try not to make it too long or convoluted. If the key numbers and the right narrative are there, you should be already quite ahead of the game.

The other part of launching a VC is a mixture of patience and a very thick skin to deal with rejection. It can take an awfully long time and a tremendous effort to launch a fund and a deck is ultimately just one element of the whole process. But it’s a useful piece of documentation to have and to constantly keep up to date for future LPs.

Happy raising! 💪

Want to see the first closing deck as google slides? If it helps, go for it. You can check it out here: bit.ly/srv_firstclosingdeck