A Brave New Startup World Is Coming

What does it mean for entrepreneurs and VC investors?

A Brave New Startup World Is Coming

We wanted flying cars, instead we got 140 characters.

Peter Thiel

TL;DR

We have come full circle around in the Startup and Venture Capital world. Twice.

From the early days of semiconductor and computer pioneers in Silicon Valley to the internet startup boom of the 90s, when having a dot-com domain was often enough to receive venture funding. And from the post dot-com bubble burst, which saw the birth of the cloud infrastructure and first global software platforms, to today's inflated market driven by cheap capital chasing a host of me-too SaaS applications.

As this latter financial cycle comes to an end too, a new class of entrepreneurs and venture capitalists are needed to once again take bold bets and solve hard problems through breakthrough engineering and commercialised science.

How Venture Capital Made Its Name And Why It Matters

In the 60s and 70s, when modern Venture Capital started, investors made money backing risky semiconductor companies that gave Silicon Valley its name. As I reported in a previous article on the history of VC, the combination of post-war US Government incentives, late 20th century regulatory changes and investment firms' embrace of limited liability partnerships, helped the very first professional VC firms outperform public markets. Their strategy of giving first cheques to a portfolio of science-driven corporate spinouts and startup teams produced huge financial returns and helped create a host of world-leading technology companies such as Fairchild Semiconductor, Intel, Apple, Cisco, Genentech, and Juniper Networks.

Thanks to the returns generated by these investors, as well as the innovation created by these startup companies, a whole new host of funds launched to join the game. The ensuing VC industry growth fuelled the birth of personal computing in the 80s and the internet in the 90s.

When It Seems Too Good To Be True

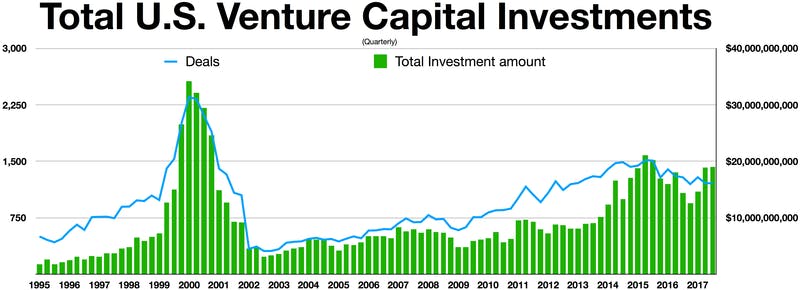

The success of those engineers-turned-entrepreneurs, and the fringe investors who backed them, kept feeding the Venture Capital industry, which ballooned in size over the last decade of the 20th century.

The newly available capital and risk-taking approach helped create the technology infrastructure that gave us the internet as we know it, with companies like Nvidia, Amazon, eBay, Google and PayPal all being founded and receiving venture funding in the 90s.

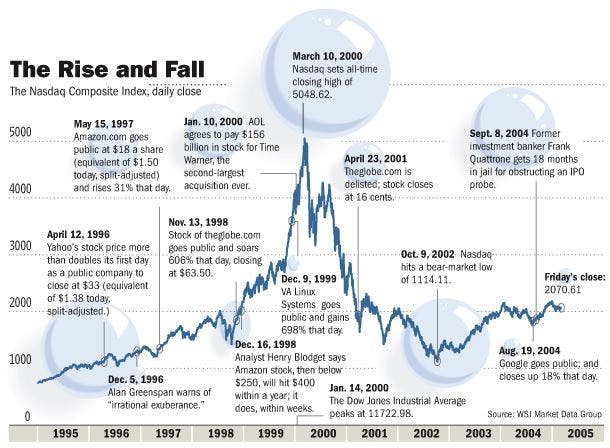

As more and more investors flocked to the game, however, healthy growth turned into hype and mania. Thanks to a cheaper and cheaper internet infrastructure and to an exponential increase in available capital, the end of the decade saw the mushrooming of hundreds of new "internet startups" ─most of which not at all worthy of the money they received. It was the infamous dot-com bubble.

After a couple of years of seemingly never-ending party, the bubble crashed. Bankruptcies spread like wildfires across both private and public companies, the stock market lost billions in value, and Venture Capital took a step back.

The Software Reboot

Software is eating the world ─Marc Andreessen (2000)

At the turn of the century, former Netscape co-founder Marc Andreessen and his business partner Ben Horowitz were interviewed in “CRN: The Newsweekly for Builders of Technology Solutions” when they were running Opsware, then called Loudcloud. He boldly stated his belief that "software is eating the world" right in the midst of the market downturn, which would bottom out two year later, in 2002. This belief helped him grow and sell Opsware as one of the first cloud-computing businesses and drove his subsequent enter in Venture Capital by founding Handreessen Horowitz and investing in Facebook, Groupon, Skype, Twitter, Zynga, and Foursquare, among others. He reiterated his belief in 2011 in his famous "Why Software is Eating the World" essay, which, in hindsight, proved correct: from the hashes of the dot-com mania would raise new software-driven companies that would shape a new era of businesses "on the cloud".

As it turned out, whilst the dot-com crash wiped out plenty of businesses and overall investor returns, some endured on both fronts and quickly began thriving. Those that did shaped a new phase of the internet, powered by cheaper server hosting and new web frameworks and algorithms. The early pioneers that invented the tools to build and then actually launched these first platforms created a huge amount of value, both for their companies and for the investors who stuck to investing in this new digital service world.

Value meant returns and such returns fuelled another investment mania that was only partly cooled by the 2008 financial crisis. Instead, it kept drawing investors to the VC world to this date.

All That Glisters Is Not Gold

Capital got cheaper and cheaper, but also launching a SaaS Platform became easier and easier. The very internet pioneers of the 90s and early 2000s, in fact, helped build both an online cloud infrastructure, which allows developers to quickly and easily launch apps, and the frameworks and algorithms that people can re-use in their own software. Therefore, an ever bigger number of investors and entrepreneurs kept chasing the dream of building billion dollar companies through "asset light" digital platforms.

What is not obvious, however, is that when Facebook revolutionised social media and when Amazon launched AWS in the midst of the 2000s, they did not simply "took a business online". They, instead, solved a host of hard technical problems that gave them a tremendous edge over any potential competition. You might have heard that "Facebook was not the first social media" and that "Amazon did not invent the cloud". Yet most people simply ascribe previous failures to "market timing" issues. This view, whilst containing some truth, ignores the fact that having a business idea does not equal to having the right technology to deliver it and succeed with it. General Magic might have had the idea of the smartphone, but it was Apple that built it and profited from it. Facebook, for example, pretty much single-handedly took PHP to its highest level of serving speed and scalability, before ditching it and inventing React) and pioneering the development concept of mobile-first Single Page Applications, to create an online experience for millions of users that just never existed before. Amazon, on the other hand, launched AWS on the back of pioneering innovation in building reliable, scalable, cost-effective data centres and creating easily accessible services via APIs.

There is a substantial difference between creating a software infrastructure that both delivers a service AND solves hard technical challenges and a software that uses pre-existing technologies to take a business idea online. However, perhaps thanks to the "quantitative easing approach" taken by central banks and governments after the 2008 financial crisis and never left since, cheaper and cheaper capital kept flushing the market.

Investors and financiers have continued to jump on the Venture Capital bandwagon at all levels and with bigger and bigger funds raised for pure financial speculation. We are now at the point that me-too copycats startups in the same industry can raise money from different investors to build yet another "B2B SaaS platform to do X" or a "Digital Consumer Platform facilitating Y". Entire new "late stage" funds have now appeared, allowing companies to raise bigger rounds than IPOs and yet remain private.

The trending philosophy seems to be: "Why bother backing "risky" new technology makers, when you can take an existing business, deploy it online on the cloud with some re-edited open-source code, and ride the money train?

A Never Ending Party...?

For now, just as it happened in 1998-99, the system seems to be working. However, just as most ".com" businesses back then, the technology innovation generated by most of today's "digital platform startups" is incremental at best and nonexistent at worst. Most of today's startups, which happen to be the ones most investors currently chase, are riding the digital market train, rather than taking bold bets and building and commercialising new technologies to solve hard problems.

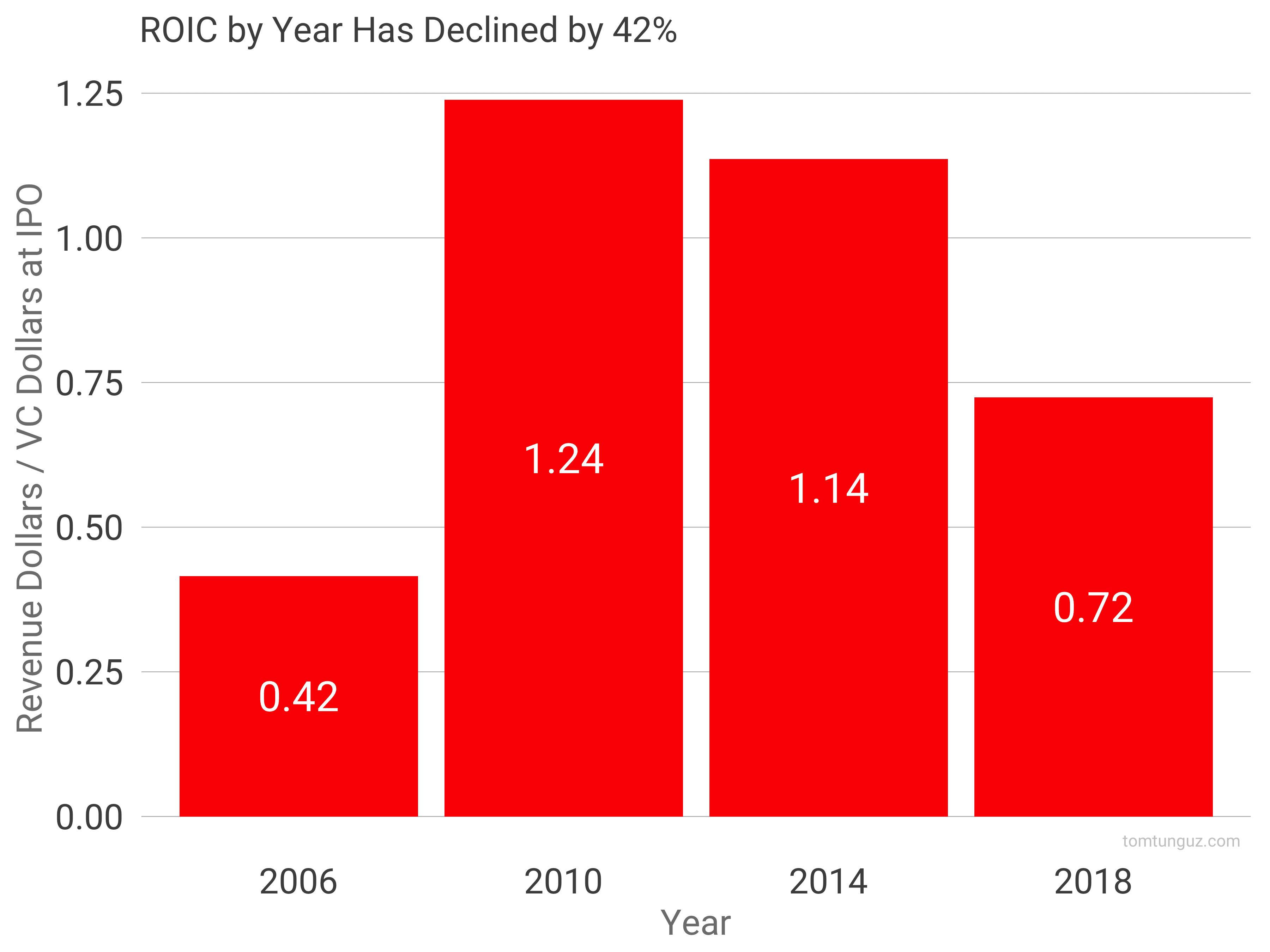

This fact, however, is driving up the cost of doing business for today's digital startups, as more and more money is poured into businesses with little to no technology differentiation amongst them and competition consequently increases.

Besides this capital inefficiency, proving that cheap does not always equal to efficient, there is also an increasing market risk. That is: when a new market crash comes along, with the consequent loss of consumer spending and investors shutting their wallets, how many of these platforms would have become a critical part of the world technology infrastructure and ensured their survival and future thriving?

In other words: how many of these low-tech startups will reveal themselves to be Amazons and Googles, rather than Webvans, Boo.coms and Pets.coms?

Finally, there is also a limit to how much exploitation the mere "digitisation" of existing businesses can bring. And the closer we get there, with more and more competition on top of this, the lower the value that this process can generate.

As columnist Dylan Tweney noted in 2011 in a piece ironically titled “Software is not eating the world":

If you’re concerned about the long-term shape of technology, software is only one dimension of many. (...)

You’ll pay Apple, RIM or Nokia for your phone. You’ll still be paying Intel for the chips, and Intel will still be paying Applied Materials for the million-dollar machines that make those chips.

Software is not eating the world. It’s merely riding on the back of an infrastructure leviathan, like a monkey on an elephant.

A (Not So) New Approach To Venture Capital

Of course, not all startup founders are out there to build yet another "platform to do X" using the very same tech stacks that are available to the rest of the world to potentially do the same. Also, not all VCs are out there looking to back "B2B SaaS" and "Digital Consumer" companies.

Sometimes hyped with fringe labels like "Deep Tech", these are actually the people that are needed today to build a brave new startup world. A new wave of startups commercialising entirely new technologies, which are both able to move us forward as a human race and help their creators survive an ever more likely new bubble crash. And just like in the 70s and 90s, they are mostly finance outsiders. Not the career VCs, MBAs, family office investors, or bankers who flock to where the money seems to be during any gold rush, but scientists escaping the academic or corporate world, technical exited founders, and engineers daring to both build and invest in what no one else dared to.

This is not just some kind of "moral" issue. As we've seen above, we can already see signs creeping in that a market downturn may be on the horizon. Moreover, all the investment mania into digital businesses with little tech differentiation amongst them has driven up competition and increased costs for these companies.

Without the competitive edge of superior technologies, modern startups won't be able to generate the value (and profits) that Fairchild Semiconductor, Intel, Apple, Cisco, Genentech, Juniper Networks, Amazon, or Google ultimately achieved. Hence a shift back to investing in high-risk science-based ventures may actually the only way for both entrepreneurs and VC investors to thrive as we approach the end of a cycle and the beginning of a new one. Plus: the market tells us that startups that actually build innovative new technologies, may not necessarily need insanely large amount of cash to succeed. Contrarily to some of the most funded startups of our age, who often end up fighting VC-funded marketing wars rather than investing in genuine R&D.

Ultimately, it goes back to what technology startups and venture capital were always meant to do: taking risky bets to build and then commercialise completely new technologies (at least partly) outside of the red tape of academic and state-led research.

When done properly, data shows that Venture Capital can magnify both business and R&D results.

Researchers from Harvard Business School showed that Venture Capital has been historically able to transform capital into new firms and innovations in a highly productive manner. The same pointed, for example, to a research from 2000 by Kortum and Lerner, that found that VC is 3 to 4 times more powerful than corporate R&D as a spur to innovation, and a 2009 one, by Kaplan and Lerner, which fond that roughly 50% of the “entrepreneurial” IPOs in the previous two decades were venture-backed, despite the fact that only 0.2% of all firms had received venture funding.

Conclusion: The New Frontier of Venture Capital

You have to be a technologist today, because there are so many different technologies. (...) So, you have to understand the technology. A person with a general business background would not make it in the venture capital business today.

─ Arthur Rock, one of the "godfathers" of modern venture capital

Venture Capital "done right" got us the silicon semiconductor revolution of the 70s and 80s, the internet infrastructure of the 90s, the cloud stacks and new web algorithms of the 2000s and 2010s, and is desperately needed today. As a matter of fact, we need VC at its best to deliver us better energy and climate-saving solutions, next-generation computing, gene-based life-improving medicine, new means of space exploration and exploitation, or even "simply" new ways for technology to deliver us from mundane as well as dangerous or heavy labour tasks, and make us cross those frontiers that we are currently unable to reach.

Breakthroughs in computing, space, robotics, semiconductors, energy, prosthetic and human augmentation, as well as food production and genetics have already started to break into the commercial space. It goes without saying that for those in Venture Capital who have both the technical expertise and risk-taking mindset required to invest early in these frontier technologies, a brave new world may just be opening up. Potentially bringing with it a value windfall not seen in a long time in the industry.